Are you tired of waiting for weeks or even months to receive payments for your contracting services? If so, then it’s time to take a closer look at your invoicing process.

Invoicing is a crucial aspect of any business, big or small. As per the reports, almost 61% of small businesses face cash flow issues in their businesses. Late payments and continuous overdue payments can be significant reasons for hampering growth and sustainability. But have you ever tried to know why it happens? What’s the reason behind it, or is there any solution to improvise?

Creating and sending professional invoices can be one of them. Effective invoicing not only ensures prompt payments but also helps to establish a professional image and builds trust with your clients.

In this blog, we’ll cover the essential elements to answer your query on what to include on an invoice to streamline the payment process.

Table of Content

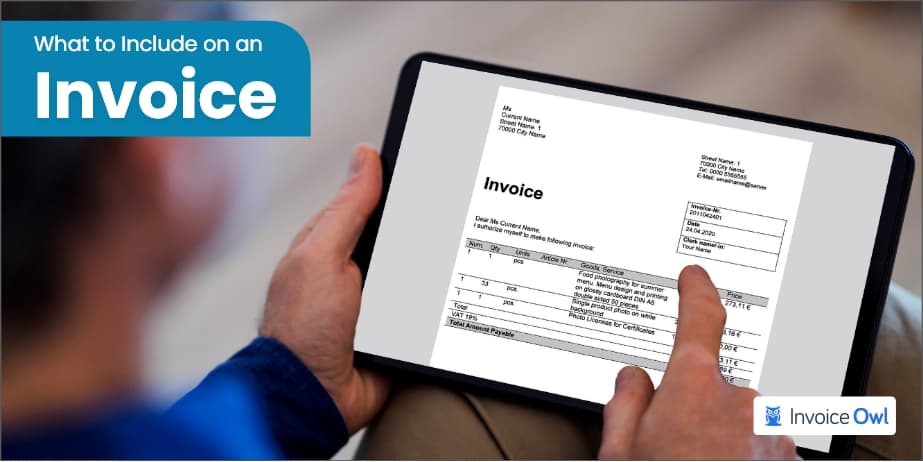

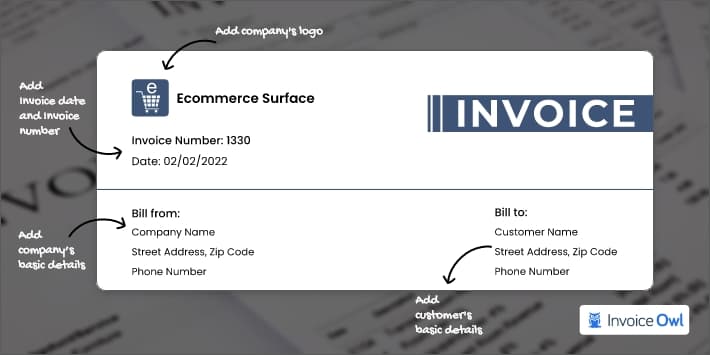

The other essential component to include on an invoice is the invoice date and invoice number.

Just as a person’s name is essential to identify them, similarly, an invoice number is essential to identify an invoice. It is a unique identifier helping businesses and clients keep track of their invoices and payment history or even for reconciling purposes.

The invoice date indicates when the invoice was prepared and when the payment is due. Mentioning the invoice date as well as the payment due date help businesses avoid any delayed payments. Also, it helps clients understand how long they have until the payment becomes overdue.

Entering the client’s name and address, as well as customer contact information is essential because it provides a clear reference of who the invoice is being sent to. This information is proof that the invoice is delivered to the correct person or organization, which can help resolve invoice disputes, discrepancies, or errors in the future.

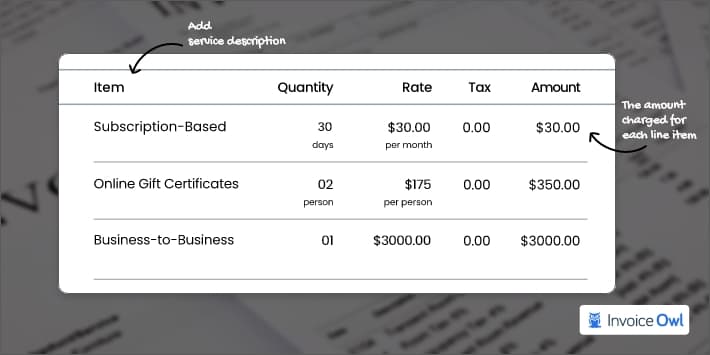

The description of the services performed is an essential part since it clarifies to clients what they are paying for. It’s crucial to include a precise, itemized list of the goods or services offered, along with the associated costs (rate per goods or service rendered) and the quantity. This can help develop confidence and transparency in the billing process

In order to accurately track the prices of the services rendered, it is essential to include the amount charged for each line item. Additionally, it enables clients to understand the invoice’s whole cost, including any applicable taxes or duties (if any). Also, when the rates of services sold are clearly mentioned, businesses will get paid faster.

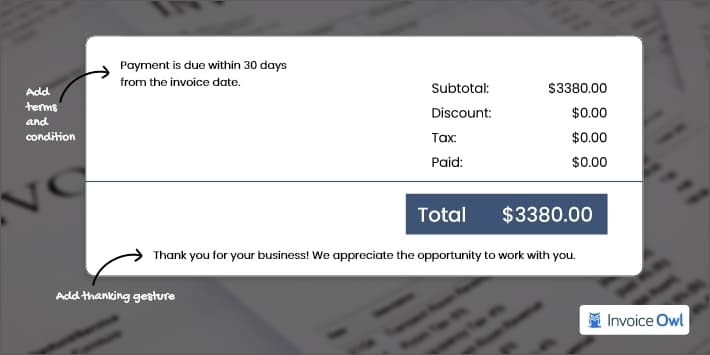

It is crucial to include all the payment details, terms, and conditions as well as acceptable payment methods. Clearly define

Clients can then better understand when and how to make payments for their invoices. Additionally, it establishes clear guidelines for the payment procedure, which may promote quick payment and minimize late fees or penalties.

Lastly, it’s a good practice to include a thanking gesture, such as a thank you note, to show appreciation to the client for their business. This can help build a positive relationship with the client and increase the chances of repeat business.

InvoiceOwl is Your One-Stop-Solution for Estimating and Invoicing!

Create professional-looking invoices in a few seconds by mentioning each and every invoice-related detail with InvoiceOwl.

Here are some of the best practices that you get help at the time when you write invoices professionally:

Delivering clear, concise, and crisp invoice information help you get prompt payments. You can actually start implementing this saying in your business as you are now well-trained enough after reading this blog post on what to include on an invoice.

So, hurry up, revolutionize your invoicing process, create professional invoices in minutes, build some credibility, and get paid faster with well-crafted invoices.

“Invoicing may seem to be a smaller part of the business, but getting it the right way can actually make a huge difference.”

Author Bio Jeel Patel FounderJeel Patel is the founder of InvoiceOwl, a top-rated estimating and invoicing software that simplifies the invoicing and estimating processes for contractor businesses. Jeel holds a degree in Business Administration and Management from the University of Toronto, which has provided him with a strong foundation in business principles and practices. With understanding of the challenges faced by contractors, he conducted extensive research and developed a tool to streamline the invoicing and estimating processes for contractors. Read More

Get weekly updates from InvoiceOwl.