We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Checkmark Expert verified

Bankrate logoHow is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Written by

James Royal, Ph.D.

Bankrate principal writer and editor James F. Royal, Ph.D., covers investing and wealth management. His work has been cited by CNBC, the Washington Post, The New York Times and more.

Edited by

Laurie Richards

Reviewed by

Thomas Brock

Thomas is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. His investment experience includes oversight of a $4 billion portfolio for an insurance group. Varied finance and accounting work includes the preparation of financial statements and budgets, the development of multiyear financial forecasts, credit analyses, and the evaluation of capital budgeting proposals. In a consulting capacity, he has assisted individuals and businesses of all sizes with accounting, financial planning and investing matters; lent his financial expertise to a few well-known websites; and tutored students via a few virtual forums.

Bankrate logoAt Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Bankrate logoFounded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner.

Bankrate logoBankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Bankrate logoYou have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

When you get a mortgage, you might expect to repay your lender over the next 15 or 30 years. However, many banks and other lenders originate mortgages only to sell them to other investors. The secondary market plays a big role in your ability to get a mortgage and how much that loan costs, yet many homebuyers aren’t aware of it or how it works. Here’s what to know.

The secondary mortgage market is a marketplace where investors buy and sell mortgages that have been securitized — that is, packaged into bundles of many individual loans. Mortgage lenders originate loans and then place them for sale on the secondary market. Investors who purchase those loans receive the right to collect the money owed.

Just like any market for securities, the value of mortgages on the secondary market depends on their risk and potential return. Higher-risk loans must offer higher returns, which is one reason why people with lower credit scores pay higher interest rates.

The primary mortgage market is where borrowers get mortgages from lenders. For example, if you go to a local credit union and a couple of banks to get a quote for a mortgage, you’re participating in the primary mortgage market.

The secondary mortgage market doesn’t involve borrowers at all. Instead, it’s where lenders sell loans they’ve originated to investors.

After originating a loan, a lender often sells it on the secondary mortgage market, though the lender may retain the servicing rights. Many lenders sell loans to the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac or other aggregators. These aggregators can repackage the loans as mortgage-backed securities (MBS) or hold them on their own books and collect the interest from borrowers.

Loans must be conforming loans to be sold to GSEs. In other words, it must meet certain standards set by the Federal Housing Finance Agency (FHFA), which oversees Fannie and Freddie. These factors include:

The demand for conforming loans helps push down the mortgage rates for borrowers who can meet the standards. Note that jumbo loans, which are larger in loan size, are not considered conforming loans.

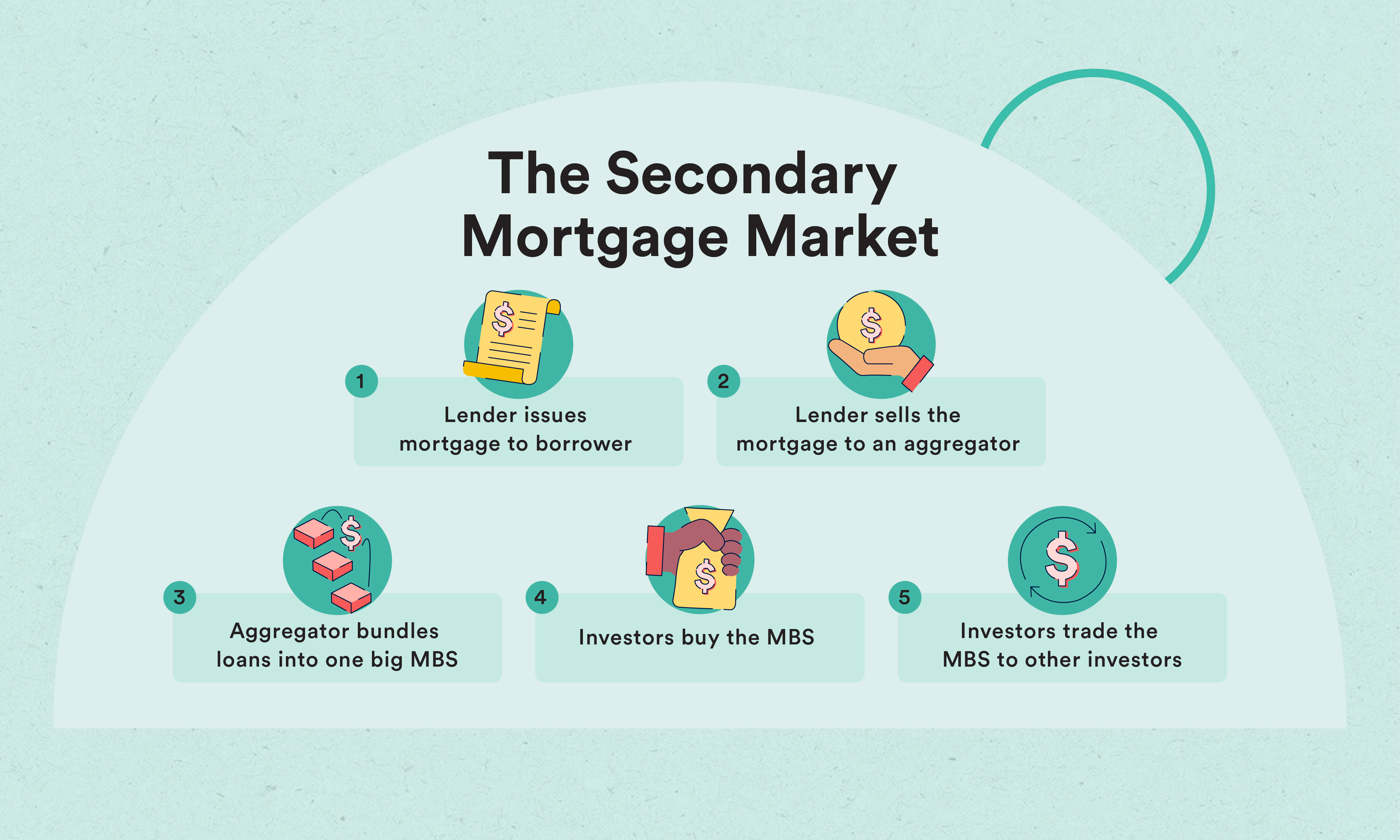

A homebuyer borrows money from a lender by taking out a mortgage (a conforming loan). The homebuyer gets cash to purchase the home, while the lender holds the buyer’s mortgage and a promise to be paid later at a specified interest rate.

The lender sells the loan to a mortgage aggregator — often Fannie Mae or Freddie Mac, who buy two-thirds of the mortgages in the U.S. The lender gets cash for selling the mortgage note, allowing it to use the capital to write another loan. The lender may retain the right to service the mortgage, a service for which it receives a fee.

The lender foregoes any mortgage repayments of principal or interest — because the aggregator now owns the loan after paying cash for it.

The aggregator repeats the process of buying conforming loans, amassing hundreds or thousands of mortgages across the U.S. Then it packages, or “securitizes,” these loans into mortgage-backed securities (MBS). For example, it might combine 1,000 mortgages into one series of MBS. Because the MBS has many mortgages, it’s less risky than buying a single mortgage — similar to a mutual fund that invests in many companies.

Aggregators can structure MBS into many different types of investment products and then sell “shares” in them. They may create a range of bonds that are very safe to a little risky, with lower payouts for the safer bonds and higher payouts for riskier notes. They may also structure the payments to MBS bonds in ways that may appeal to certain investors. For example, many MBS only pay interest to investors while some pay principal; others pay a combination.

If an aggregator has also purchased the mortgages’ servicing rights, it may retain them and service the underlying loans or sell them to a third party.

The aggregator puts the MBS up for sale to investors — pension funds, mutual funds, insurance companies and other income-oriented investors. The aggregator receives cash, which it can use to buy more mortgage notes for later repackaging. In turn, the investor receives the MBS, which it can hold and collect income on (from the mortgage payments) or later sell to another investor.

Eventually, the MBS matures, and the investor is paid off. With this cash, the investor can then purchase another MBS or invest elsewhere.

Imagine you take out a mortgage to purchase a new home. The lender gives you the funds to purchase the property, and you agree to pay the money back over a certain number of years. On the back end, however, the lender sells your mortgage to the secondary market for cash. This gives the lender more capital to lend to more borrowers.

There are a few things that can happen to your mortgage once it’s sold to the secondary loan market. The buyer may decide to hold your mortgage and collect the interest, or your loan could be bundled with other home loans and sold as a mortgage-backed security. Ultimately, what the lender decides to do with your mortgage does not impact you as the borrower.

Creating a completely new security from mortgages is a complex process, so why would the players involved in the mortgage market do this? The secondary market creates benefits for each economic player — including borrowers, investors, banks/lenders, aggregators and rating agencies.

Because it allows lenders to slice up their mortgages, the secondary market also enables financial firms to specialize in various market areas. For example, a bank may originate a loan but sell it on the secondary market while retaining the right to service the mortgage.

As a loan originator, the bank underwrites, processes, funds and closes the loan. It collects fees for these services and then may or may not hold onto the loan.

As a loan servicer, the bank receives a fee for processing the monthly payment, tracking loan balances, generating tax forms and managing escrow accounts, among other functions.

Even if the lender decides to keep the loan it originated, it benefits from having an active and liquid secondary market where it can sell its loans or servicing rights.

Advantages and disadvantages of the secondary mortgage market include:

Mortgage lenders make money in the secondary market when they sell a loan. Selling a mortgage gives the lender access to liquid capital, which allows them to write new mortgages and sell them.

Fannie Mae and Freddie Mac support about 70 percent of the mortgage market and are two of the biggest purchasers in the secondary mortgage market, according to the National Association of Realtors.

In 1938, Congress established the secondary mortgage market by creating Fannie Mae. This move provided liquidity for lenders, allowing them to issue more loans without tying up capital for extended periods. In 1970, Freddie Mac was formed with similar objectives. It acted as a market-maker to facilitate the buying and selling of mortgages, encouraging lenders to extend financing with the assurance of being able to sell the loans. Before this secondary market, lenders typically held onto the loans they originated, which limited the availability of mortgages based on individual bank capacities and loan book space.

Standard criteria were established to ensure loan quality, leading to the creation of conforming mortgages. Today, the secondary mortgage market enables those meeting conforming loan standards to secure funding for their mortgage, even if local lenders are not inclined to hold onto the loan.

Arrow Right Principal writer, investing and wealth management

Bankrate principal writer and editor James F. Royal, Ph.D., covers investing and wealth management. His work has been cited by CNBC, the Washington Post, The New York Times and more.